The 3Par acquisition is a slam dunk at under $2 billion. The company has great enterprise-grade SAN technology and a proven ability to sell into high-end accounts but lacked the revenue to go it alone. A major enterprise IT vendor like HP or Dell (not to mention Oracle, IBM, or even NetApp) will kick sales into high gear. Even with no further product development, any of those vendors can profit from this acquisition.

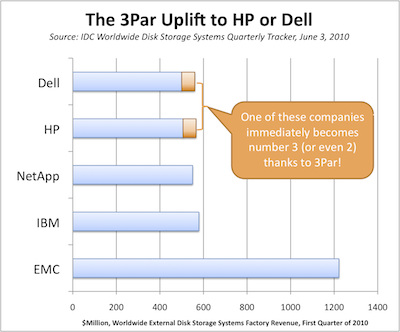

But there’s an amazing short-term win to be had for whoever acquires 3Par. According to IDC, the race for number two in external disk storage system sales is a bitter fight. IBM, NetApp, HP, and Dell are all within striking distance of each other, pulling in between $500 and $579 million dollars while big daddy EMC makes more than any two of them. The battle between HP and Dell in storage arrays is a dead heat, with just $6 million separating the two.

It’s no wonder HP and Dell are fighting over 3Par! That acquisition is good for an easy $50 million in quarterly revenue, and a strong sales push could make this $60 million. This extra revenue cements the buyer ahead of his rival and makes him a challenger to IBM and NetApp. It wouldn’t be all that surprising to see the winner vault into the number 2 spot within a year.

This is a huge win for HP or Dell and a serious egg-on-the-face moment for NetApp, IBM and the loser. Sure, $1.7 billion is a lot to pay for $250 million in revenue, but the winner gets immediate bragging rights and a serious prospect of breaking free of the second-place pack. 3Par’s technology is unique in being a real tier-1 threat. This was an issue for the company as a startup, but becomes a serious asset in the hands of HP or Dell (or, dare I suggest, Oracle or NetApp). A well-executed transition and sales execution will cement HP or Dell as the most-credible competitor to EMC within a few years.

Stephen’s Stance

The 3Par acquisition makes so much sense, one wonders why it didn’t happen sooner. Dell clearly sees this as a higher-end repeat of their success with EqualLogic and gives them a chance to earn some additional enterprise credibility. An HP acquisition makes just as much sense, giving them fresh SAN technology and letting them pull ahead of Dell once again. A big deal like this also gives HP’s Dave Donatelli some internal clout in the aftermath of the Hurd fiasco. I expect a counter-offer or two before this is done, but 3Par remains attractive at even a billion more.

Will anyone else join the fray? IBM seems happy with XIV, though the market doesn’t see that product as tier-1. I expect them to stand pat. Oracle should jump in, given the souring of their Sun-era Hitachi OEM deal. Passing on 3Par leaves them with no enterprise SAN chair when the music stops, but they might not feel that they need this kind of hardware. Cisco could use the 3Par technology to reject EMC, but they might not be ready for that move. Another idea is perennial second-place storage company NetApp, who might be able to afford to play this game and could really use a new product line.

What’s left for the loser? Not much. There isn’t another startup with credible tier-1 SAN intentions. Compellent is a great alternative in the midrange SAN market, and Xiotech has great SAN technology here, too. Everyone assumes Oracle will pick up Pillar, and then there’s BlueArc and Isilon waiting in the NAS space. But none of these are a slam-dunk in terms of market share, and the value question looms large when it comes to any high-P/E acquisition. Expect more acquisitions in the coming quarters, but the 3Par game looks like a highlight.

Based on the NetApp end of quarter based on 30th July 2010 figures the fight for number two is already won. This is for number 3 today. Are you seriously saying that with the 3Par purchase HP or Dell will accelerate past NetApp’s current 36% growth rate?