Dell and EMC announced today that they have reached a deal to combine, taking EMC private and retaining control of VMware. But this transaction is complicated by EMC’s 80% stake in VMware. Let’s consider the value of that substantial and important holding and what it means for the Dell offer.

How Analysts Value EMC Stock

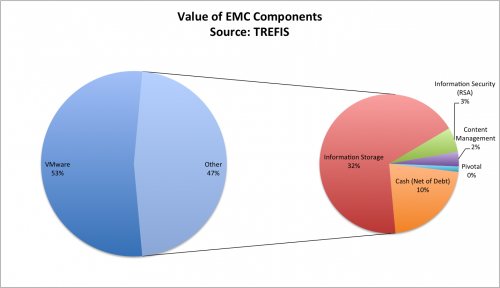

According to TREFIS, EMC’s value is split between their 80% stake in VMware and their remaining assets at a ratio of about 53% to 47%. And the current price of EMC stock (about $28 per share) places their overall market cap at $53 billion. So these analysts would have us believe that EMC’s ownership of VMware is worth about $28 billion, while the rest of EMC is worth about $25 billion.

For what it’s worth, this analysis puts the value of EMC’s storage components at about $17 billion, RSA at $1.4 billion (they paid $2.1 billion), “Content Management” at $851 million, and Pivotal at $319 million.

How The Market Values EMC Stock

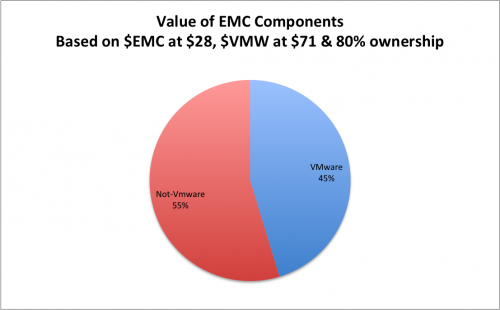

Another way to look at the value of EMC’s stake in VMware, and thus the value of EMC itself, is to subtract 80% of VMware’s market cap from EMC’s. If VMware (at about $71 per share) has a total market cap of about $30 billion, then EMC’s 80% share of that should be worth about $24 billion. This leaves about $29 billion of EMC’s $53 billion market cap to account for the rest of the company.

Thus, according to the wisdom of the market, EMC’s value is split about 45% to 55% between VMware and not-VMware. This ratio varies widely over time, since any change in the price of EMC or VMW stock will alter the ratio quite dramatically. For example, if EMC lost two dollars and VMW gained two, the split would be almost exactly 50/50.

What Is Dell Offering For EMC?

Although the “big number” being bandied about in the news is $33.15 per share, or $67 billion, Dell is not actually offering $33.15 per share for EMC. Instead, they’re offering to give each shareholder$24.05 in cash, plus .111 shares of a new stock that will track the value of VMware. Since $24.05 is about 72.5% of 33.15, Dell would appear to value the non-VMware components of EMC 60% more than the market or the analysts believe. But that’s not exactly what Dell is doing either.

Under the current offer, Dell would buy EMC and keep their current 80% ownership of VMware. That $24.05 per share is for both EMC’s non-VMware stake and their VMware stake. The new VMware entity they’ll offer isn’t a share of VMware at all but rather a “tracking stock” with no rights or intrinsic value.

Under this offer, Dell would get EMC and 80% of VMware for a substantial discount to the current market price for either. They would pay about $45 billion to shareholders ($24.05 per share) and get 80% of VMware at 95% of the current price, the rest of EMC at 78.5% of the current value, and leave shareholders hoping their VMware tracking stock is worth something.

Stephen’s Stance

I’m not a stock analyst, and this is merely my own quick calculation, but this doesn’t seem like a good deal for shareholders. Dell walks away with a huge amount of value and shareholders are left hoping for the best. No wonder shares of EMC are still well below the alleged “$33.15 per share” offer price! Right now, it looks like they’re valuing that VMware tracking stock at only $4 per share, not the $9 Dell hoped.

Disclaimer: I’m not even an amateur stock analyst! Do not make investment decisions based on what I wrote here!

Stephen, it’s interesting to see that the market is essentially valuing the VMware tracking stock at around $4. Clearly there’s a lot of negativity being seen from a VMware perspective, their shares are down nearly 11% today.

This deal is all about VMware & EMC-II, with the remainder of the federation portfolios a side issue. I wouldn’t be surprised to see them sold off/floated as non-core business. So the market must assume that under Dell, VMware wouldn’t fare as well. Now, that might not be about Dell’s ability to exploit the asset, but that partnerships such as that with HP will be in direct competition to Dell; Dell may want to cut those back and so lose revenue. For a combined Dell the result may be good; for a standalone VMware, not so good. Lots of angles to this deal to think about.

The fact that Elliot is very positive about the deal indicates that they think it’s a fair price. I can’t imagine them being so positive if they thought they could get more money.